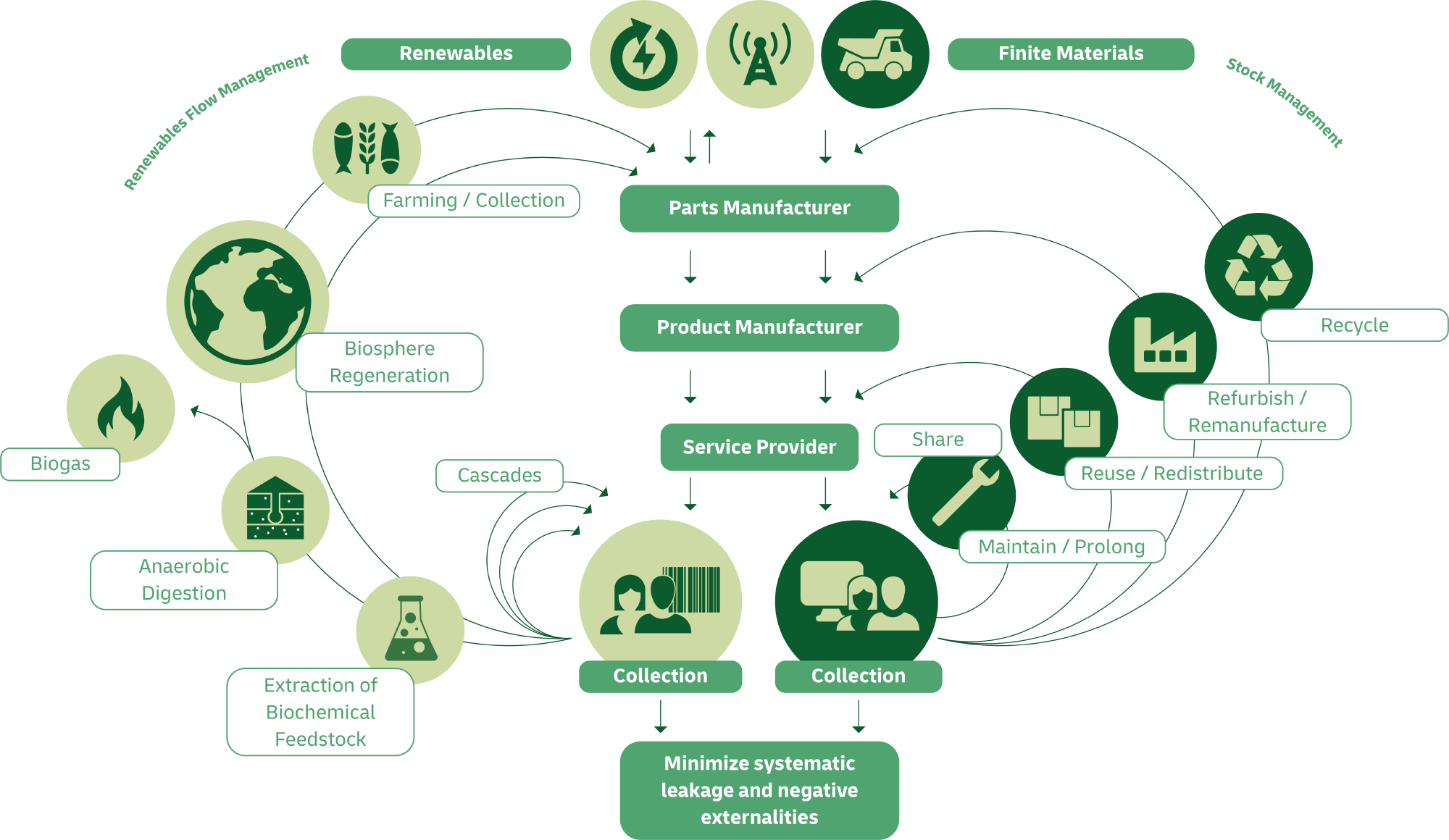

The trend of Circularity aims to eliminate waste and pollution by considering the full product lifecycle in advance, designing and utilizing each item and its constituent parts to be returned in the supply chain. This trend seeks to reuse, repair, remanufacture, and recycle products as much as possible and, when these processes are no longer achievable, products are broken down into reusable components and raw materials and ultimately biodegraded.

There is gradual but unsteady progress towards a circular economy. Although 55% of large businesses have committed to circularity, more than half of their initiatives are narrowly confided to recycling or waste management. Many companies’ strategies are not yet encompassing the full range of technologies and business models for a circular economy, for example, re-engineering products to last longer, embracing repairability, adopting leasing models, reducing virgin material use and providing complementary services throughout the lifecycle of a product.

The Circularity Gap Report reveals the vast majority of materials entering the economy over five years to 2023 were virgin, with the share of secondary materials declining from 9.1% to 7.2%. However, new legislation is likely to strengthen progress. A good example of this is the European Commission’s new rules on the ‘right to repair’ for consumers, which may incentivize companies to implement more sustainable solutions.

Circularity concepts require dramatic transformation of the processes of product design, production, and recycling, which is why the supply chain is a key enabler of this trend managing and moving flows of raw resources, goods, returns, and waste among a new network of users in a sustainable, circular manner. Circularity as a trend is therefore likely to significantly impact the logistics industry, with logistics players becoming essential sources of knowledge for the transfer of best practice across sectors. But current momentum to explore, invest in, and adopt circular products and solutions appears lacking. Hence, it will take considerable time for circularity to achieve maturity and widespread adoption along the supply chain.