The Commercial Invoice is a crucial document in international trade, detailing the goods being imported or exported, along with the transaction's terms and conditions. It is essential for customs procedures and duty calculations.

This article covers the definition, role, description, and preparation of the Commercial Invoice, highlighting practical tips. Given the complexities of varying tax systems, laws, and regulations, customs clearance often requires specialized customs brokers. However, the exporter typically prepares the Commercial Invoice.

Why is the Commercial Invoice so important?

In international shipping, the term “invoice” largely refers to the “commercial invoice.

A commercial invoice is an official document detailing the value and quantity of goods in international transactions, along with delivery terms. It is recognized by customs and financial institutions, making its information legally binding. This invoice not only requests payment but also serves as contractual evidence of international trade. Accuracy is crucial, as errors can cause customs delays, payment issues, and delivery setbacks.

Additionally, the commercial invoice helps exporters and importers confirm contract details, clarifying transaction value and incoterms to manage cost sharing and transportation risk effectively. Inaccuracies can lead to future disputes over costs and responsibilities.

Role of commercial invoice in customs procedures

At customs clearance, duties and import taxes are calculated based on the information on the invoice. The product name, quantity, and unit price on the invoice are extremely important in the application of item classification and tariff rates

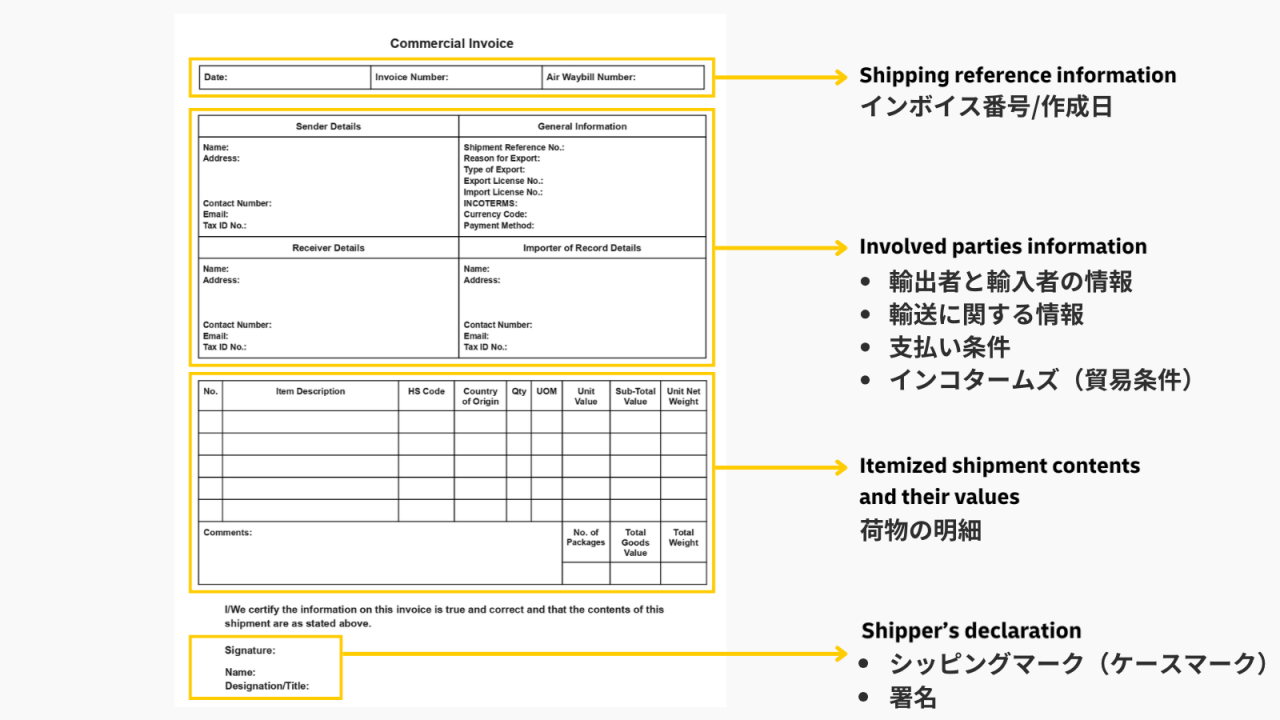

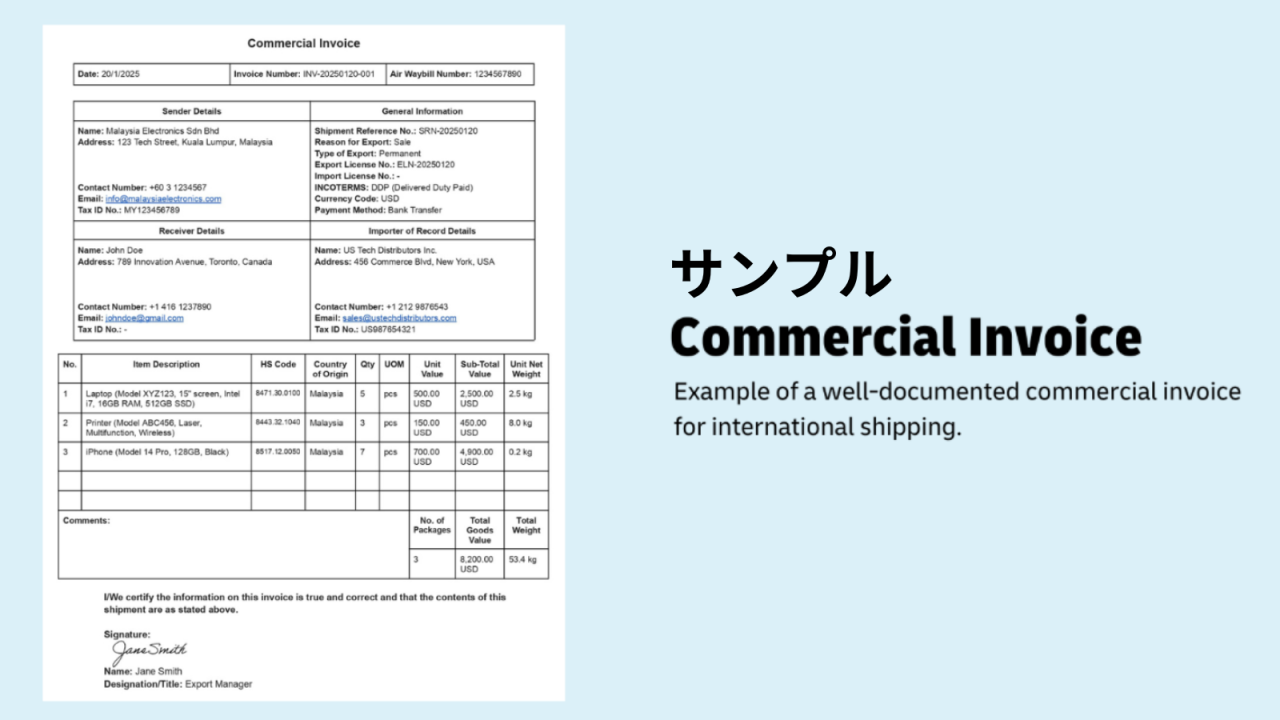

Key information to include in a Commercial Invoice

The format of the commercial invoice is flexible to some extent, and there is no strict format. However, there are certain items that must be included, and they must all be covered in a comprehensive and easy-to-understand manner. If there are multiple pages, it is recommended to include page numbers and reference codes to make it easier to read.

In addition, the Commercial Invoice has the effect of preventing misunderstandings between the exporter and importer regarding the details of the contract. Incidentally, since some trading partner countries may require additional information, prior confirmation is always recommended.

Commercial invoice checklist:

- Language to be Used: This will generally be English.

- Invoice Number/Creation Date: There is no particular rule, and any number that is easy to manage can be used. The invoice creation date should also be indicated.

- Exporter Information: Corporate name, name, address, telephone number, e-mail address.

- Importer Information: Corporate name, name, address, telephone number, and e-mail address. If the importer and the delivery address of the package are different, a separate entry is required.

- Information on Transportation: Description of the means and method of transportation, including the flight number and scheduled departure date of the ship, plane, etc. to be used. If the cargo is to pass through a transit point, then the transit point must also be stated.

- Terms of Payment: This section describes the method of settlement for commercial transactions with business partners. For example, T/T Remittance and Irrevocable Letter of Credit (L/C) are commonly used for payment.

- INCOTERMS®: These clearly state who bears the costs of international trade, such as transportation costs, customs clearance costs, and duties, and to what extent. Following the terms of trade established by the International Chamber of Commerce (ICC) and its interpretation will maximize your chances of avoiding problems with later reimbursement of expenses.

- Description of Cargo: The Commercial Invoice must include the item name (official name or model number), quantity, unit price, and total value, along with weight and volume. Clearly indicate the currency and market value (this cannot be zero). For customs officers’ easy verification, include the goods’ intended use, materials, place of origin, and Harmonized System Code (HS code). A photograph of the goods may also be added. Accurate information is crucial for determining tariff rates, as errors can lead to delays and incorrect tariff calculations.\

- Shipping Mark (Case Mark): Also known as a cargo mark. It is required to avoid confusion with other cargo.

There is no set format, but it should be simple and easy to understand. Generally, the name of the importer, the destination of the shipment, the box number, and the place of origin should be indicated - Signature: The signature of the preparer is required on the commercial invoice. In some cases, the signature is required to be handwritten.

Quick tip!

Clearly state the name of the product. For example, “sample” alone may result in the customs delays as it is not clear what the shipment is.

Check out DHL Express My Global Trade Service (MyGTS), a free online portal for international trade. You can search for HS codes, calculate costs, including customs duties, and check customs restrictions and prohibitions in each country. It also allows you to calculate estimated landing costs for any country and estimate the total costs of shipping, helping you optimize your pricing strategy.

Differences Between Commercial Invoice and Other Documents

How does the Commercial Invoice differ from other documents in terms of role and content? Let's compare it with two typical documents that are often mistakenly used.

In trade transactions, multiple documents such as estimates, contracts, and shipment invoices are utilized, but the Commercial Invoice is positioned as the final invoice document. Since each document has a different purpose and role, it is important to use them differently to avoid mistakes and duplication.

Commercial Invoice vs Proforma Invoice

A pro forma invoice is considered similar to a provisional invoice or a quotation, and since it is not legally binding, it is often treated as a reference document to confirm the details of a formal transaction. In contrast, a commercial invoice is the basis for the final contract and invoice, and is meant to be an official document that is also submitted to customs.

Commercial Invoice vs Packing List

A packing list is a document that specifies the actual quantity and weight of goods packed and the form of packing, and is used to confirm the breakdown of the shipment. The clear difference is that the commercial invoice clearly states the price and payment terms and also serves as an invoice. In some importing countries, a packing list is not required.

In any case, the important thing is to be consistent in the document content when preparing multiple documents.

Tips on How To Write a Commercial Invoice Efficiently

Here are some key points and tips to streamline the process of creating an accurate and smooth commercial invoice.

Using preset invoice templates

Preparing a template makes it easier to check all the necessary items at once and greatly prevents omissions and mistakes. In addition, by introducing a trade management system or cloud service, you can centrally manage everything from document generation to the approval process, thereby reducing human error and speeding up operations.

Quick tip: DHL Express offers MyDHL+, an online tool for creating commercial invoices along with waybills. The tool is free to use to register and use.

Use a standard format

Invoices lack a strict format but generally follow this layout:

- Header: Exporter and importer information

- Middle: Product details and pricing

- Bottom: Signature column and total amount

The key is to ensure the document is easy for customs and counterparties to review quickly.

How to prevent errors

To enhance document accuracy, implement a double-checking system and utilize automatic data entry through system integration. Linking warehouse and logistics systems can minimize manual input errors.

Additionally, stay updated on language and local regulations, and consult experts in logistics to further reduce risks.

Common mistakes in a Commercial Invoice

Ensure accurate shipment description to avoid delays and added costs

Incomplete product names and quantities can cause delays and incur additional costs during transportation. Ensure accurate information from the start.

Customs relies on invoice information to calculate duties and permit imports. Unclear entries can prolong the confirmation process. Follow detailed rules for importing countries and consult logistics specialists if needed.

Work closely with your international business and shipping partners

Invoices may need importer confirmation, so avoid misunderstandings regarding language or currency. Ensure clear communication with suppliers to prevent discrepancies and facilitate smooth contracts, settlements, and customs clearance.

Value of Digitalization of Commercial Invoices

The digitization of commercial invoices is advancing in trading operations. Here are the key advantages and considerations:

Advantages of Digitization:

Transitioning from paper to cloud-based systems streamlines the creation, storage, and verification of customs documents, enabling timely information sharing with distant partners. Benefits include shorter shipping schedules and faster updates.

Benefits of E-Invoicing:

Electronic invoicing reduces time and costs associated with managing and mailing original invoices. Centralized cloud management facilitates smooth confirmations, making e-invoicing a powerful tool for improving operational efficiency and reducing paper use.

Utilizing Online Trade Document Systems:

Online systems allow for centralized management of documents like invoices and packing lists. Joint editing and sharing on the cloud enhance communication with overseas partners, enabling real-time updates and minimizing errors.

Precautions When Digitizing:

Implement robust security measures to prevent unauthorized access and information leaks. Consider using electronic signatures and certification authorities that comply with local and international regulations. Organize your operational flow and create a transition plan for a smooth system introduction.

Conclusion: Importance of Commercial Invoice and Key Points for Future Trade Operations

A commercial invoice is the official invoice in trade transactions, and the key document in all situations, including customs and transportation procedures. If it contains accurate information, it can lay the foundation for smooth customs clearance and good relationships with trading partners.

By maintaining consistency with other documents such as proforma invoices and packing lists, and by improving operational efficiency through digitization and the use of templates, your international business will be growing smoothly in no time.