HS code, the short for Harmonized System code is a numerical code used by customs worldwide to identify and categorize import and export shipments.

The global standardized HS code has 6 digits. The first 6 digits remain standard around the world and allow standardization global trade.

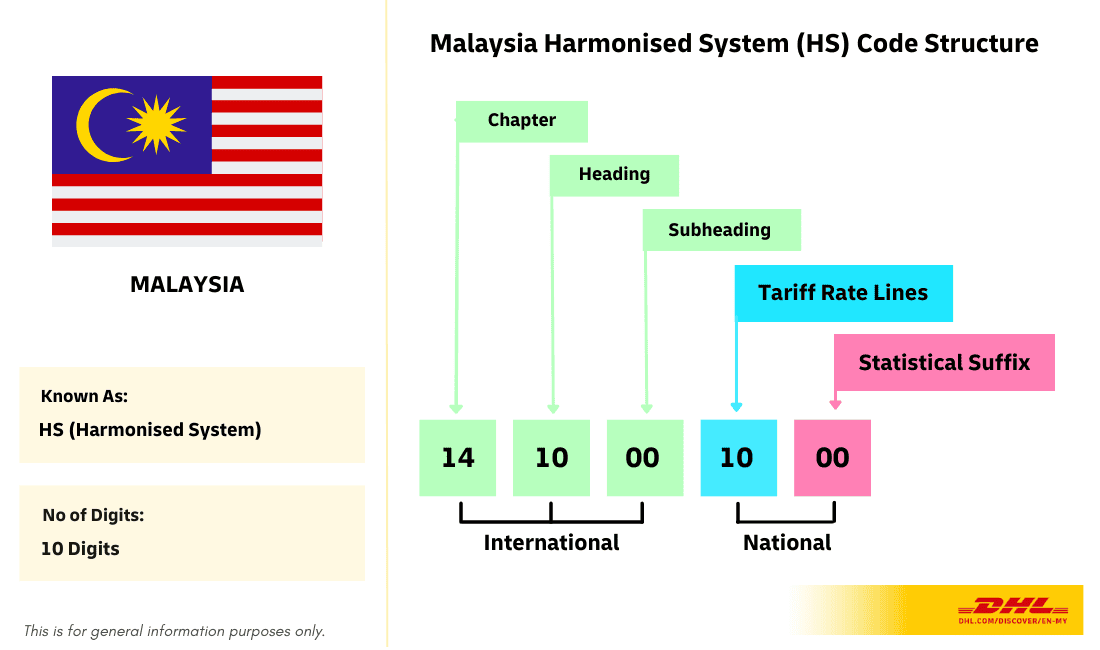

Some countries have added extra digits at the end of HS code for sub-classification.

In Malaysia, the custom follow 8 digits HS code. The first 6 digits are from the global HS code list and the last 2 digits has been added by JKDM (Royal Malaysian Customs Department).

HS codes are also commonly referred to as tariff codes. You can search for Malaysian HS codes using the JKDM Explorer tool.

FREQUENTLY ASKED QUESTIONS

About HS Code

What is HS code?

HS code is the shorten form of Harmonized System code. It is a global customs classification system that helps customs worldwide classify shipments, regulate shipments entry, and determine taxation.

Shippers use it to declare their international shipments and check customs duties.

HS code has 6 digits. Additional digits are added by countries for sub-classification of products.

Hence, HS code for certain countries is longer than 6 digits.

While most countries call it the HS code, some use slightly different names. For instance:

In Malaysia, it's known as HS code or tariff code and consist of 8 digits.

The United States refers to it as HTS code (Harmonized Tariff Schedule) and consist of 10 digits.

India uses terms like HS code, HSN code (Harmonized System of Nomenclature), or ITC-HS Code (Indian Trade Clarification based on Harmonized System of Coding) and consist of 8 digits.

How is HS code structured?

The 6 digits HS code classify all the products into chapters, heading and sub-heading. It consists of 21 chapters and each chapter further classified into heading and then into subheadings.

The first 2 digits are for chapter, the middle 2 digits are for heading and last 2 digits are for sub-heading.

Countries may extend it to 7 to 12 digits, known as commodity codes or national tariff lines to suit their specific needs.

HS Code in Shipping

How to get HS code for a product in Malaysia?

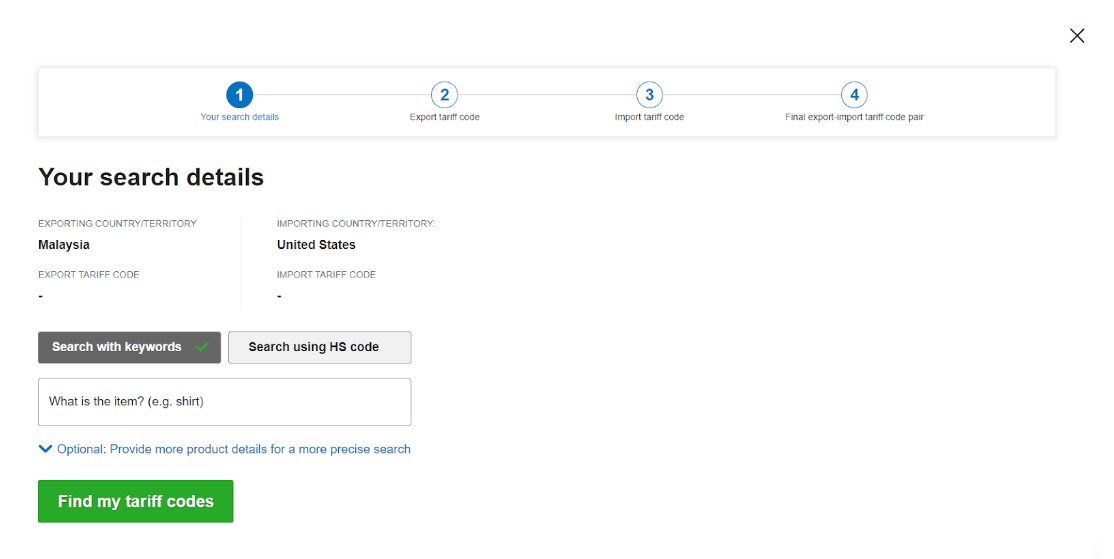

You can use our HS code finder, known as MYGTS to search for your product’s tariff code in the exporting and importing country.

Each country has its own HS code. You should always refer the HS code of your recipient’s country.

Follow these 5 steps to find your HS code instantly:

Sign up or login to MyGTS.

Select exporting country and importing country of your shipment.

Click “Find My Product’s Tariff Code”.

Select “Search with Keywords”

Enter keywords of your product.

*Be as accurate and specific as you can. Example: Search liptstick, not makeup product.

DHL MYGTS HS Code Finder

DHL MYGTS HS Code Finder

Why is HS code important?

Customs relies on this code for accurately classifying shipments, controlling goods entry, and precise taxation.

As a shipper, you need the HS code to declare shipment, check shipment restrictions, and calculate shipment duties.

What happen if I use the wrong HS code?

Your shipments could face 5 common issues:

Shipment delays due to detention or inspection.

Fine, penalties and confiscation.

Incorrect customs duty charge.

Denial of entry.

Rejection of tax exemption request in free-trade agreement or De Minimis.

HS Code in DHL Shipping

How does DHL Express classify goods using HS code?

DHL refers to the HS code shipper provides on invoice.

If the HS code is missing, customs will classify the product based on the customs regulations of the country, and DHL will follow customs' final decision.