Malaysian government has enacted the Free Zones Act of 1990 to establish duty-free zones within the country to simplify customs regulations and facilitate trade activities.

What is a Free Trade Zone (FTZ)?

A free trade zone (FTZ) in Malaysia is a specific area where businesses can operate with minimal customs checks and tax exemptions for most goods and services. Put simply, it's a place where production materials or goods are exempted from the usual import and export rules and taxes in Malaysia, except for items prohibited by law.

Such customs relief offers businesses exclusive trade and commercial advantages, with the main benefits being duty and tax exemptions.

The absence of customs duties, excise taxes, and sales tax means that manufacturing, industrial, and commercial activities is more cost-effective. However, it's important to note that certain goods within a free zone may still be subject to duties and taxes.

These include:

- Forklifts

- Cranes

- Construction/building materials and equipment

- Office equipment or furniture

- Firefighting and pollution control equipment

- Motor vehicles and spare parts

- Petroleum and petroleum products

- Tyres

- Explosives and chemicals

- Air conditioning equipment

- Goods imported or transported into a free zone for use or consumption in a free zone

- Wine, spirits, beer, malt liquor, tobacco, and tobacco products imported or transported into Tasik Kenyir Duty-Free Area.

- Cigarettes, tobacco products, smoking pipes (including pipe bowls), electronic cigarettes and similar personal electric vaporising devices, and preparation of a kind used for smoking through electronic cigarettes and electric vaporising devices, in the form of liquid or gel, whether or not containing nicotine.

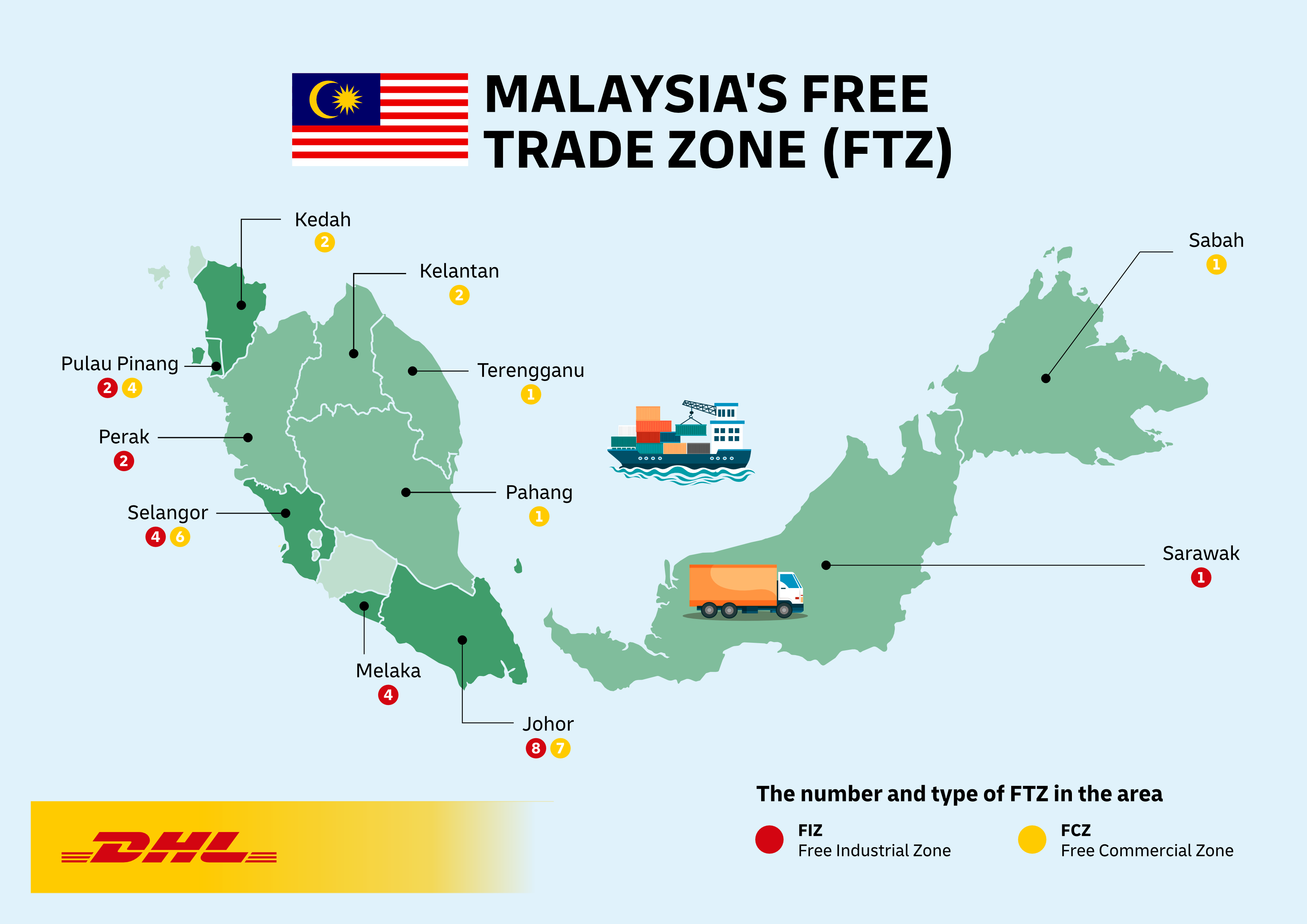

There are 2 types of free trade zones - Free Industrial Zone (FIZ) and Free Commercial Zone (FCZ).

1. Free Industrial Zone (FIZ)

A FIZ is a designated area established for manufacturers that import all their raw materials and manufacture goods for export.

Companies seeking to operate in FIZs must import all their raw materials and export at least 80% of their production.

The only exception available is for companies with a 60% export rate. However, these companies must obtain special permits from the Ministry of International Trade and Industry (MITI). They can sell the remaining 20% of their production domestically in Malaysia but as imported goods, which means the finished goods will be subject to Malaysia's standard import duties and taxes.

2. Free Commercial Zone (FCZ)

Different from FIZ, FCZ is created to promote commercial and trade activities in Malaysia, such as trading, grading, and repacking materials obtained by trading within other free zones, relabeling, bulk breaking, transhipping, and others.

Companies operate in this zone are prohibited from conducting any retail trading in FCZs. This rule applies to all FCZs, except for Rantau Panjang Free Zone (Kelantan), Stulang Laut Free Zone (Johor) and Bukit Kayu Hitam Free Zone (Kedah).

What are the advantages of operating in Malaysia free trade zones?

Cost of Operation and Labor

Businesses gain a competitive edge from Malaysia's comparatively low operational costs and labor expenses.

With support from policymakers across all sectors, businesses operating in Malaysia's FTZ not only benefit from special tax incentives and reduced or eliminated customs duties but also have easy access to affordable skilled labor. This enables businesses to sustain high-quality production with optimized operational costs.

Governmental Focus

Free Trade Zones receive dedicated attention and support from the Malaysian government.

Through regulatory bodies like the Malaysian Investment Development Authority (MIDA) and Malaysia External Trade Development Corporation (MATRADE), ongoing efforts are made to assess and refine the existing free trade policy. The nation's commitment to fostering a favorable trade environment conducive to growth places high emphasis on cross-border trading incentives, customs procedures, and duties and tax exemptions.

Connectivity

Malaysia is among the Asian countries with robust transportation infrastructure.

The country's well-connected air, sea, and road networks ensure efficient movement of goods domestically and internationally. To support import and export activities, all Free Trade Zones (FTZs) in Malaysia are strategically positioned near major ports, airports, highways, and railways. This strategic positioning allows for seamless transportation of goods and raw materials, minimizing transit times.

How to set up a business in a Free Zone?

Step 1: Register as a Private Limited Company (Sdn Bhd)

The business can be foreign-owned, locally owned, or a branch company (requirements may differ based on preferred Free Trade Zones and business activities), but registration with SSM (Companies Commission of Malaysia) is mandatory.

Step 2: Meet FTZ License Requirements

Paid-Up Capital The business must have at least RM 500,000 to RM 1 million in paid-up capital to qualify for a free trade zone license |

Permits and Licenses Company must obtain permits and licenses to operate in a Free Trade Zone. Depends on the FTZs and business activities, FTZ application usually takes around 4 months. |

Physical Presence Company must maintain a physical office within the permitted Free Zone. |

Step 3: Register as Customs's SMK Dagang Net User

Company must register with Malaysia's customs as a SMK Dagang Net user at the official dagang site.

Step 4: Acknowledge by the Authorities of Selected Free Zone

Company must register directly with the authorities of the free zone they choose.

Who are the Free Zone Authority in Malaysia?

The Free Zone Authority is a regulatory body appointed by the Ministry of Finance in Malaysia.

They can be any statutory organization established under Malaysian federal or state government laws or even a company. Their primary role is to administer, maintain, and operate the free zones within the country.

When a company, including a fully foreign owned company, intends to operate within a free zone, it must secure prior approval from the Free Zone Authority. This is to ensure compliance with the regulations and guidelines governing these special areas.

Where are the free zones located?

In Malaysia, there are 22 Free Industrial Zones (FIZ) and 24 Free Commercial Zones (FCZ).

Port Klang Free Zone, Pasir Gudang and Bayan Lepas are among the most popular one.

To set up a business in a FTZ, shortlist the area that is most strategic for the business and contact the relevant authority to verify eligibility before proceeding with the application.