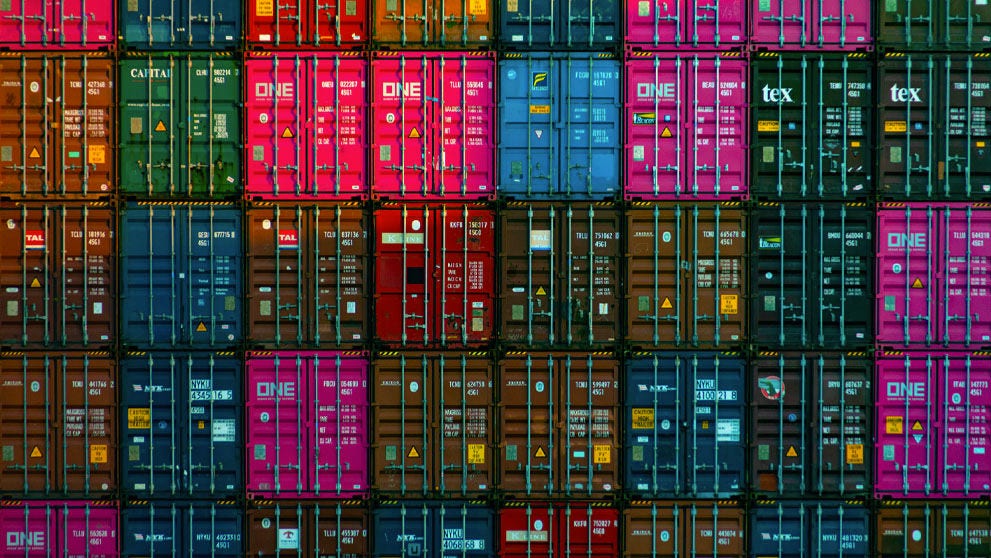

Vietnam is one of the fastest growing economies in Southeast Asia, with its imports valued at over US$330 billion, as reported by The World Bank. However, to safeguard domestic industries and regulate the flow of goods in the market, Vietnam has imposed import duties on most goods. For businesses that have the intention to export their goods to Vietnam, it is important for them to know how the Vietnamese authorities implement import duty and taxes.

What are Vietnam’s import tax rates?

Vietnam's customs import duty rates is dependent on the type of product and whether it is regulated by the government. The country’s custom tariff comprises two parts: the import duty and the value-added tax (VAT). The import duty is a flat rate that is applied to all imported goods, while the VAT is a percentage-based tax for specific goods regulated by the government.

According to Vietnam Briefing, luxury items like cars and perfumes are subject to higher tariffs, whereas machinery and non-domestic consumer goods are levied with lower import tariff rates. Ensuring payment of import taxes at customs is essential to avoid clearance delays.

Vietnam’s customs import duty rates include:

- Preferential tariff rates: This is applicable for goods from countries that enjoy the Most-Favoured-Nation (MFN) treatment in their trade relations with Vietnam.

- Special preferential tariff rates: This is for goods imported from countries that have a Free Trade Agreement (FTA) with Vietnam. Currently, ASEAN nations enjoy a common preferential tariff (CEPT).

- Ordinary tariff rates: This is for products that do not qualify for Vietnam’s MFN import duty treatment.

Types of Vietnam Import Tariff

Besides the standard Vietnam import duty, there are additional taxes imposed on goods entering Vietnam:

Value-Added Tax (VAT): The importer of the goods has to pay additional taxes for the added value in the supply chain. Vietnam’s VAT rates for imported goods can be 0%, 5%, or 10%. Certain goods, such as daily necessities that cannot be produced in Vietnam, are exempt from VAT.

Special Consumption Tax (SCT): Consumer goods that are considered luxury items are subject to SCT. Products subjected to SCT are also subjected to VAT.

Environmental Protection Tax (EPT): According to Vietnam Law & Legal Forum, goods that might have a harmful effect on the environment are subject to EPT. It is a great way to prevent countries from ignoring the environmental impacts the products might cause when providing goods and services. As per the Vietnam Pocket Tax Book 2021, EPT rates vary for each commodity from VND500/kg for restricted chemicals to VND50,000/kg for plastic bags.

Vietnam’s import duty rates are calculated by multiplying the value of the imported goods by the applicable tax rate:

Import tax = tax rate x (value of imported goods + VAT (if any) + SCT (if any) + EPT (if any)).

You can determine the import tax rate for goods using the Harmonised system (HS) Code. The codes from HS also indicate whether the goods are subject to VAT, SCT, or EPT. You can also determine your shipment’s import duties and taxes with the DHL duty calculator.