As Malaysian SMEs look to expand their markets overseas, understanding and complying with international shipping regulations is crucial.

Whether you're a seasoned exporter or new to international trade, these insights will help you efficiently navigate the complexities of export and import and avoid common international shipping pitfalls.

Tip 1 - Understand Malaysia’s Customs Regulations

Familiarizing yourself with local customs regulations is the first step before you venture into international shipping. Learning about these regulations ensures that your business is compliant with local laws and can navigate the initial stages of the shipping journey effectively.

The authority that oversees the enforcement of all customs laws related to the export and import of goods is the Royal Malaysian Customs Department (RMCD)

Here are the 4 basics you need to know:

- Prohibited and Restricted Items: Identify items that cannot be exported from or imported into Malaysia to avoid legal complications.

- Documentation: Prepare all the necessary documents such as Commercial Invoice, Air Waybill and Certificate of Origin.

- Duties and Taxes: Understand the fees associated with exporting and importing goods.

- Customs Clearance: Learn about the clearance process your goods will undergo at Malaysian borders.

Tip 2 - Different Countries, Different Customs Regulations

Like Malaysia, every other country has its own customs regulations concerning what can be imported and exported, along with specific duties and taxes. Not understanding these rules can lead to your shipments being delayed or rejected at the destination country’s customs.

To help you manage this complexity, we have created comprehensive shipping guides for several key countries. This will help you understand what to expect when shipping to these destinations and ensure smoother transactions.

- North America: the United States and Mexico

- Asia-Pacific: China, Japan, and Hong Kong

- Oceania: Australia

- Europe: the United Kingdom, Italy, Germany, and France

- Africa: South Africa

Tip 3 - Understand Common Customs Terminology

After familiarizing yourself with the fact that customs regulations vary by country, you will notice and encounter a variety of customs terms that are essential to understand. These terms can vary from country to country, even if they describe similar processes or regulations.

For example, the Harmonized System (HS) Code is a standardised numerical method of classifying traded products.

It is used by customs authorities around the world to identify products when assessing duties and taxes. Different countries may refer to it with slight variations:

You can find the HS Code for your products by using our HS Code search guides, for Malaysia HS Code and international HS Codes.

Other key shipping terms such as:

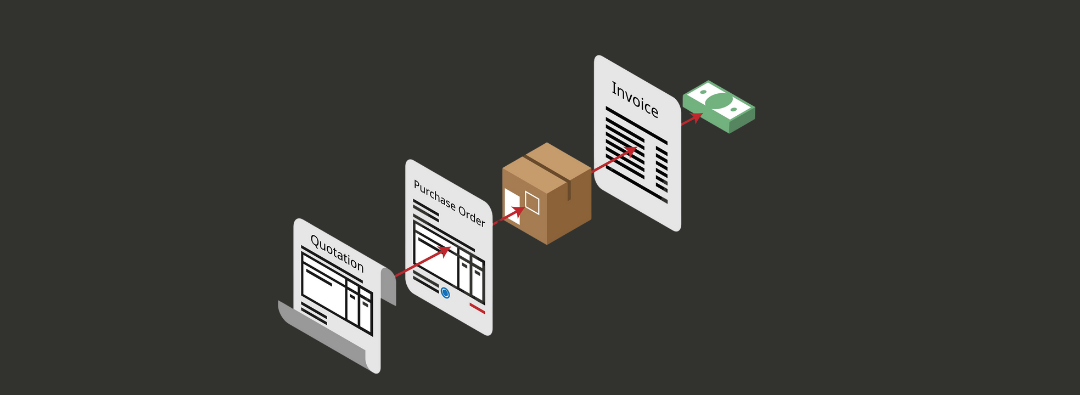

Incoterms: These are international commercial terms defining the responsibilities of buyers and sellers involved in the shipment of goods. They clarify who pays for what, and at what point the responsibility for the goods transfers from the seller to the buyer.

Landed Cost: This is the total cost of a product delivered to the buyer, which includes the purchase price, freight, insurance, and other costs up to the port of destination.

Dimensional Weight: Used to calculate the shipping cost based on the volume (size) rather than the actual weight, which can affect the cost if the goods are less dense.

Understanding these terms is essential, as incorrect usage can lead to costly mistakes. For example, confusing 'DDP' (Delivered Duty Paid) with 'DAP' (Delivered at Place) might result in unexpected obligations for sellers to pay duties, leading to unplanned expenses.

Tip 4 - Check for Restricted items and Required Licenses

After understanding customs terminology, it’s essential to verify that your products meet legal requirements. Some items may be restricted and need specific licenses or approvals before exporting from Malaysia or importing into another country.

For example, exporting electronic devices like smartphones and laptops out of Malaysia is straightforward. However, importing them into Malaysia requires you to obtain a special approval or import license from SIRIM (Standard and Industrial Research Institute of Malaysia), depending on their intended use.

You can use the Customs HS Code searcher tool to find out whether your goods are restricted or need special authorization when importing into Malaysia.

Here’s 4 steps on how to use it:

Step 1: Visit the Customs HS Code Searcher.

Step 2: Select “Prohibition Schedule.”

Step 3: Choose either “Import” or “Export.”

Step 4: Enter the name or type of item you plan to ship.

This will help you identify any specific requirements to ensure your shipments comply with Malaysian regulations.

Tip 5 - Apply the Correct Duties and Taxes

Once you have confirmed that your products can be legally shipped, the next important step is to understand how duties and taxes will affect your shipments.

When importing goods, you will encounter duties and taxes that must be paid before Customs will release your items. These fees help regulate the flow of goods into and out of the country, generate government revenue and protect local industries from international competition.

For goods entering Malaysia, you will generally deal with three main charges:

- Import Duty: A tax on imports based on the value, type and origin of the goods.

- Sales Tax: Applied at the point of import to the sale of goods.

- Excise Duty: Applied at the time of import to specific products, such as alcohol or tobacco.

For goods entering other countries, the duties and taxes will vary by country. To help you navigate these, we have comprehensive guides for several key countries, including:

- Southeast Asia: Singapore, Indonesia, Thailand and Vietnam

- East Asia: China, Japan, South Korea, Hong Kong and Taiwan

- South Asia: India

- Western countries: the United States, the United Kingdom and Australia

You can also get a quick estimate of your duties and taxes by using DHL HS code and duties checker.

Tip 6 - Explore Tax Exemption or Reduction Options

Once you are familiar with the duties and taxes, exploring opportunities for tax exemptions or reductions is your next step towards cost efficiency. Exporting and importing regularly or in large volumes can get expensive due to duties and taxes charged.

Fortunately, Malaysia offers several facilities that can reduce or even eliminate these costs, helping to boost your business exports and encouraging economic growth.

For example:

Licensed Manufacturing Warehouses (LMW): Utilize LMWs to obtain exemptions on import duties and taxes for raw materials and components that are used in manufacturing products destined for export.

Free Trade Zones (FTZ): Operating from an FTZ allows you to conduct manufacturing and commercial activities without the burden of standard taxation rules.

Free Trade Agreements (FTA): Agreements between countries that reduce or eliminate import/export duties, promoting trade for your business under favourable terms.

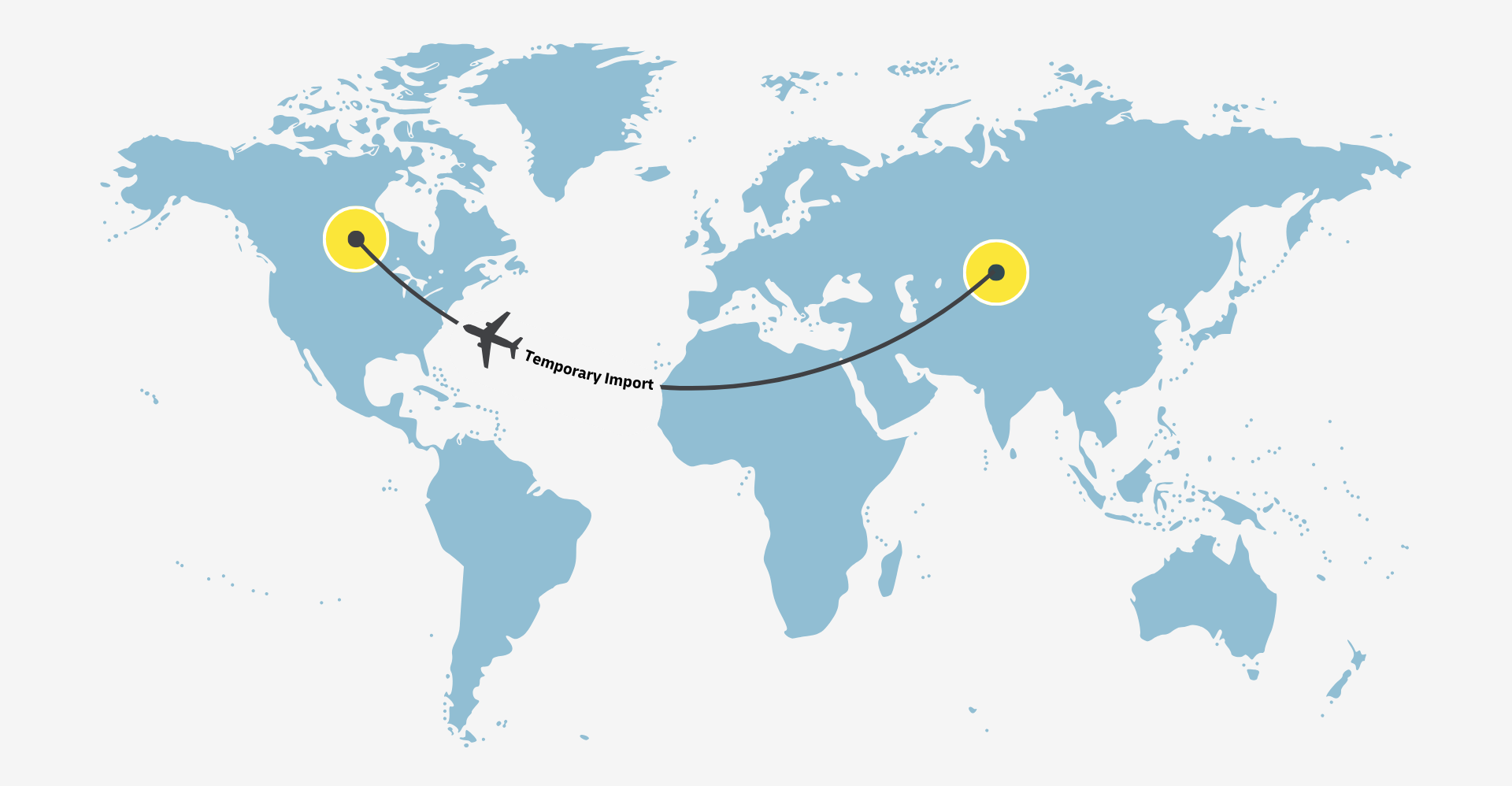

Temporary Import: For goods imported for specific short-term purposes such as exhibitions or repairs, temporary import permits allow duty-free entry into Malaysia, with the condition that the goods will be re-exported within a set timeframe.

ATA Carnet: Simplifies temporary exports across 77 countries, bypassing customs procedures and eliminating duties and taxes for items that will return to their country of origin within the validity period.

Tip 7 - Use the Right Packaging and Label Correctly

Once you've grasped the basics of international shipping, the next practical step is to ensure your goods are properly packaged and labelled. This not only protects your products but also enhances your brand's image.

Choosing the right packaging is not just about putting your items in a box. The size, durability, and material of the packaging can significantly affect your shipping costs and the safety of your goods.

- Size: Using a box that's too large can increase shipping costs, while a box that's too small may not provide enough protection for your items.

- Material: Ensure the packaging is strong enough to protect your goods from damage during transit, opting for eco-friendly packaging, or temperature-sensitive packaging.

- Appearance: Packaging also plays a role in marketing. A well-designed package can enhance your brand's image especially if customers share their unboxing experience online.

Proper labelling is essential to ensure that your shipments reach their destination without delays and comply with regulations.

- Clarity: Always use typed labels instead of handwriting to avoid misunderstandings caused by unclear scripts.

- Complete Information: Include all necessary information such as the recipient's address, return address, and any custom-related information.

- Placement: Place the label securely and ensure it is visible and not covered by any packaging tape.

By following these packaging and labelling guidelines, you help ensure that your goods are protected during transit and that they arrive at their destination on time and in good condition, thereby maintaining your brand's reliability and trust with customers.

Tip 8 - Choose the Right Shipping Partners

Selecting the right shipping partners is crucial for the smooth and safe transportation of your goods internationally. This decision can significantly impact the efficiency, reliability, and overall customer satisfaction of your business operations overseas. You have to consider the following 6 criteria:

- Understand Your Needs: Assess the specific shipping services your business requires, whether it's shipping sensitive goods like medical samples, temporary import service, express import and export, same-day delivery, etc.

- Competitive Pricing: Evaluate the pricing models and rates offered by different shipping companies to find the best deal that meets your budget and service expectations.

- Value-added Services: Opt for companies that offer a range of supplementary services such as packaging, storage, and final delivery. These services can greatly simplify logistics management for your business, providing a one-stop solution for all your shipping needs.

- Customs Expertise: Ensure that the shipping partner has proven capabilities in managing customs clearances and other related procedures. This expertise is crucial for avoiding delays and ensuring compliance with international shipping regulations.

- Extensive network: Choose a shipping provider with a broad international network. This ensures that your shipments can be delivered seamlessly to various global destinations without the need to switch providers.

- Reliable Post Shipping Service: Ensure that the shipping partner offers comprehensive tracking options and sufficient insurance coverage. This not only provides peace of mind but also protects your financial interests against loss or damage during transit.

If you’re new to international shipping, partnering with an experienced logistics provider like DHL Express can be particularly beneficial. With our comprehensive suite of services and global expertise across 220 countries, we can enhance your shipping operations and ensure a positive experience for both you and your customers.